6.10. Economic Analysis¶

6.10.1. Economic Parameters¶

General economic parameters can be defined opening the tree item “Economic analysis” -> “Economic Parameters”

Parameters used in the economic analysis

- Inflation rate: general inflation rate.

- Rate of increment of energy prices: rate of increment for fuel and electricity costs. May be different to the general inflation rate.

- Time for the economic amortisation of the investment: defines the time frame for economic analysis

- Nominal interest rate of external financing: capital cost for the company

- Company specific discount rate: discount rate for intermediate positive cash flows (re-investment), used for MIRR calculation).

External financing

It is possible to consider also (partial) external financing of the investment. In this case the following parameters should be defined (by default 0% external financing is assumed).

- Percentage of external financing

6.10.2. Cost Details¶

6.10.3. Overview on the Economic Analysis¶

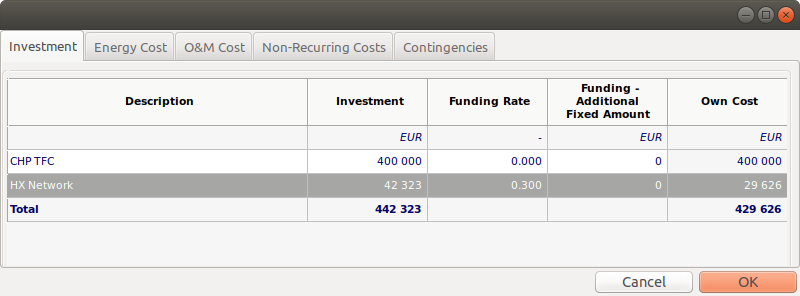

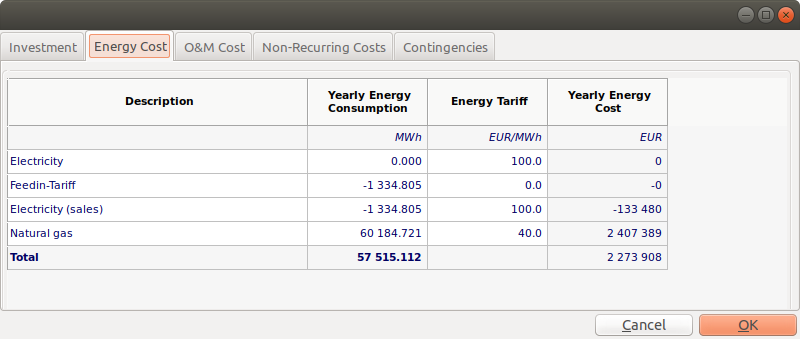

Under the main menu item “Economic Analysis” -> “Cost Details” you can manually edit / add / delete the following cost categories:

- Investment costs: total investment cost, subsidies and - resulting by difference - own investment cost

- Energy costs: fuel, electricity etc. costs incl. expected increase in energy prices

- Operation and maintenance costs: yearly costs due to operation and maintenance (materials, labour, etc.)

- Non recurring costs: singular costs which do not occur regularly every year, such as e.g. replacement of (parts of) equipment, irregular maintenance, permits, legal costs, prevention costs etc.

- Contingencies: eventually occuring costs associated with some uncertainty (risk). Contingencies are accounted for as yearly costs from a certain start year onwards

Costs for investment, energy costs and O&M costs are pre-filled automatically after concluding system simulation.

6.10.4. Results¶

The results of the economic analysis are given in in the main menu item “Economic Analysis”.

In a table the most relevant global parameters (investment cost, benefit cost ratio, IRR, pay-back) are given.

In the graphic the yearly cash flow and the net present value (NPV) of the cumulative cash flow is given.

A comparative analysis of the economic performance of different alternatives can be done as described under Comparative Analysis